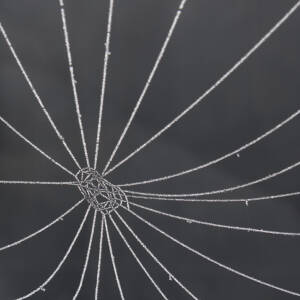

Outside

One of the great things about the education system in England has been its many different routes to learning and qualifications. For people who, for whatever reason, haven't been able in school to get the three A levels (the school-leaving qualification) required for university entrance, further education colleges have offered both the two-year A-level course (full- or part-time) and 'access courses' (an alternative to A levels as a route into university).

So the shiny new 24+ loans for further education being advertised on the sides of buses made me think something alarming was a afoot. Too right: it turns out they are masking a vicious rule change from September. Although most (not all) under-24-year-olds without qualifications will still be able to do pre-university study free, those 24 or over will have to pay between £3,000 and £5,000 per year for a full time A-level course. No wonder they need loans.

Coincidentally a secret report about university student loans that the government commissioned from the Rothschild investment bank was made public today (thanks to freedom of information legislation). It turns out that the government wants to sell the loans to the private sector who, of course, need their profit. So the low interest rates guaranteed by the government when student loans were introduced 15 years ago to cover the new £1,000 a year fees, are a problem. Although the terms worsened when fees increased to £3,000 in 2006 and worsened again when fees were hiked to £9,000 two years ago, the interest rates were still lower than for bank loans.

So Rothschild is suggesting tearing up the contracts under which students took loans, and hoiking the rates 'to make the loans more attractive to prospective private buyers'.

Gaze on through the windows, children. Education for all was never that great an idea anyway.

(This is an English issue: education is managed much better in Scotland and slightly better in Wales.)

Comments

Sign in or get an account to comment.